The floor to be used in applying the lower of cost or market method to inventory is determined as the a.

The floor to be used in applying the lower of cost or market method.

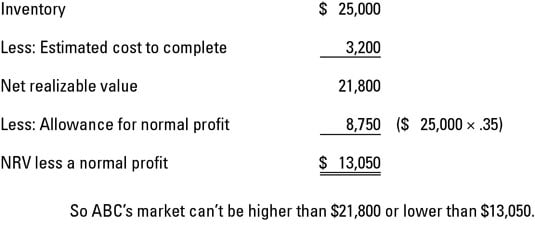

Net realizable value less normal profit margin.

Net realizable value less normal profit margin.

Lower of cost or market as it applies to inventory is best described as the a drop of future utility below its original cost.

Selling price less costs of completion.

Selling price less costs of.

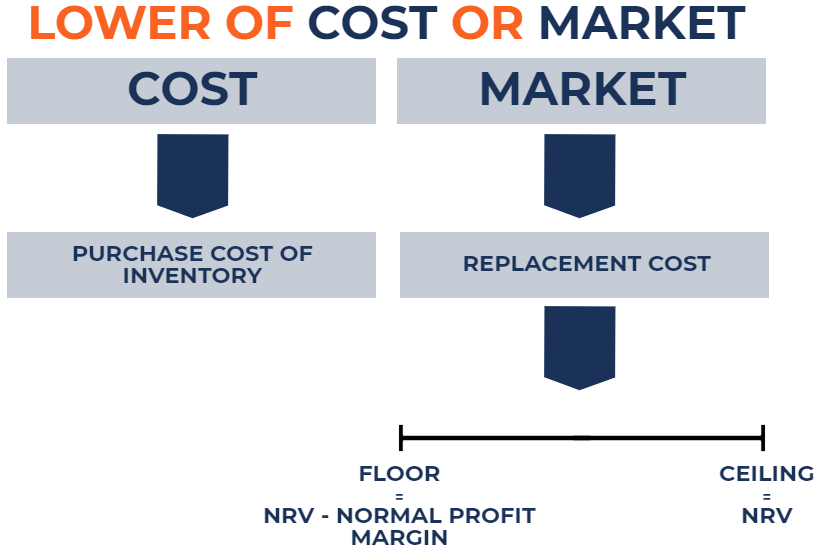

The lower of cost or market lcm method relies on the fact that when investors value a company s inventory those assets shall be recorded on the balance sheet at either the market value or the.

The floor to be used in applying the lower of cost or market method to inventory is determined as the a.

Net realizable value less normal profit margin.

D change in inventory value to market value.

Net realizable value less normal profit margin.

C assumption to determine inventory flow.

Net realizable value less normal profit margin.

A current replacement costs b net realizable value c net realizable value less a normal profit margin when the direct method is used adjust cost to.

The floor to be used in applying the lower of cost or market method to inventory is determined as the a.

The floor to be used in applying the lower of cost or market method to inventory is determined as the selling price less costs of completion and disposal.

The floor to be used in applying the lower of cost or market method to inventory is determined as the.

Selling price less.

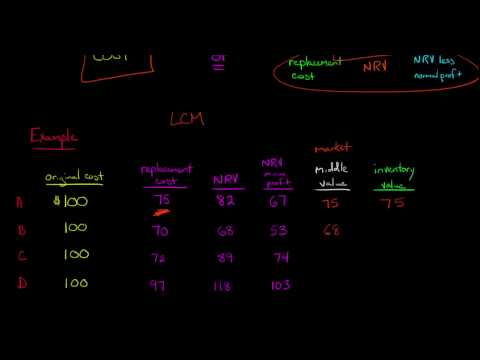

You can apply lower of cost or market lcm to the entire inventory or you can cherry pick between inventory items.

B method of determining cost of goods sold.

The general rule is to apply lcm on an item by item basis because this method is the most conservative.

The floor to be used in applying the lower of cost or market method to inventory is determined as the a.

Selling price less costs of.